Kiekvienam verslui, kuris susiduria su atidėtais klientų mokėjimais, yra svarbu įvertinti ir apskaičiuoti galimą riziką. Pasitaiko atvejų, kai klientas nusiperka paslaugą, tačiau nesugeba įvykdyti savo įsipareigojimų. Dažniausiai to priežastis – neįvertintas kliento rizikingumo lygis.

Klausiate savęs, o kaipgi aš galėčiau patikrinti savo klientus? Salesforce CRM su naujuoju įrankiu RiskPlanner jums padės tai padaryti!

RiskPlanner yra sukurtas verslo rizikų ir finansavimo iššūkių valdymui. Tai prekybinių sandorių valdymo, vertinimo ir auditavimo instrumentas, sukurtas #1 CRM platformoje – Salesforce.

RiskPlanner sprendimas teikia įmonei šias naudas:

- Prieigą prie papildomo kapitalo

- Didesnius savarankiškus draudimo limitus

- Naujus pirkėjus dėl paprastesnio draudimo suteikimo

- Skolų portfelio valdymą

Žemiau pateikiame keletą realių situacijų, kuriose RiskPlanner gali padėti Jūsų verslui sumažinti riziką, priimti geresnius sprendimus bei didinti pardavimus.

1. Galėsite lengvai įvertinti naują klientą

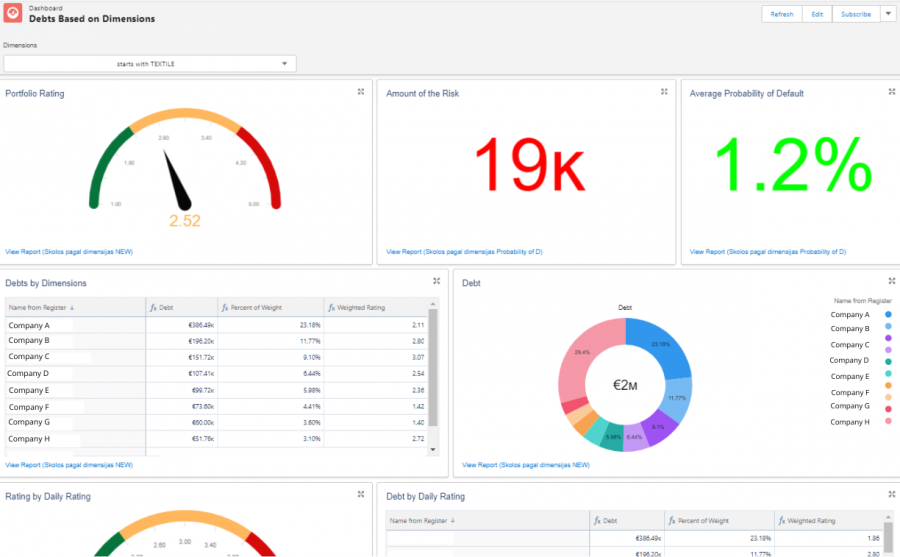

1) Jūsų įmonės pardavimų vadybininkas gauna naują užklausą iš kliento el. paštu. Klientas – Company ABC.

2) Pardavimų vadybininkas keliais paspaudimais suveda naują klientą į RiskPlanner sistemą el. pašte ir iš karto pamato kliento – Company ABC – kredito įvertinimą.

Company ABC kredito įvertinimas yra C lygio, vadinasi, jis yra vidutiniškai rizikingas. Šalia matoma lentelė su rekomenduojamu kliento kredito limitu, kuris yra 30 000 EUR. Tai yra rekomenduojama suma, už kurią klientas galėtų užsisakyti iš jūsų paslaugas.

3) Vadybininkas, neišeidamas iš el. pašto sistemos, Salesforce CRM’e suformuoja pasiūlymą ir išsiunčia jį klientui. Klientas akimirksniu gauna pasiūlymą el.paštu su visa reikalinga informacija.

Nauda: Pardavimų vadybininkas gali itin greitai suvesti kliento informaciją į RiskPlanner ir realiu laiku matyti kliento rizikos balą bei pateikti jam geriausią pasiūlymą. Tai ypač svarbu pardavimams telefonu – Jūs surinksite daugiau informacijos nei konkurentai ir su RiskPlanner parduosite daugiau bei saugiau.

2. Gausite informaciją apie klientą realiu laiku

1) Jūsų įmonės pardavimų vadybininkas susitinka su klientu ir kalbasi apie paslaugų pardavimą.

2) Kartu jiems besikalbant, pardavimų vadybininkas gauna pranešimą (angl. notification) mobilioje aplikacijoje, jog pasikeitė kliento finansinė informacija – ji pagerėjo, kadangi įvyko klientų portfelio pervertinimas.

3) Pardavimų vadybininkas su džiaugsmu praneša klientui, jog jo kredito reitingas ką tik pakilo ir jam yra didinamas kredito limitas.

Nauda: Pardavimų vadybininkas gali klientui daugiau parduoti. Rezultatas – sukontroliuota rizika, didesni pardavimai bei išaugusios pajamos.

3. Galėsite didinti pardavimus klientams

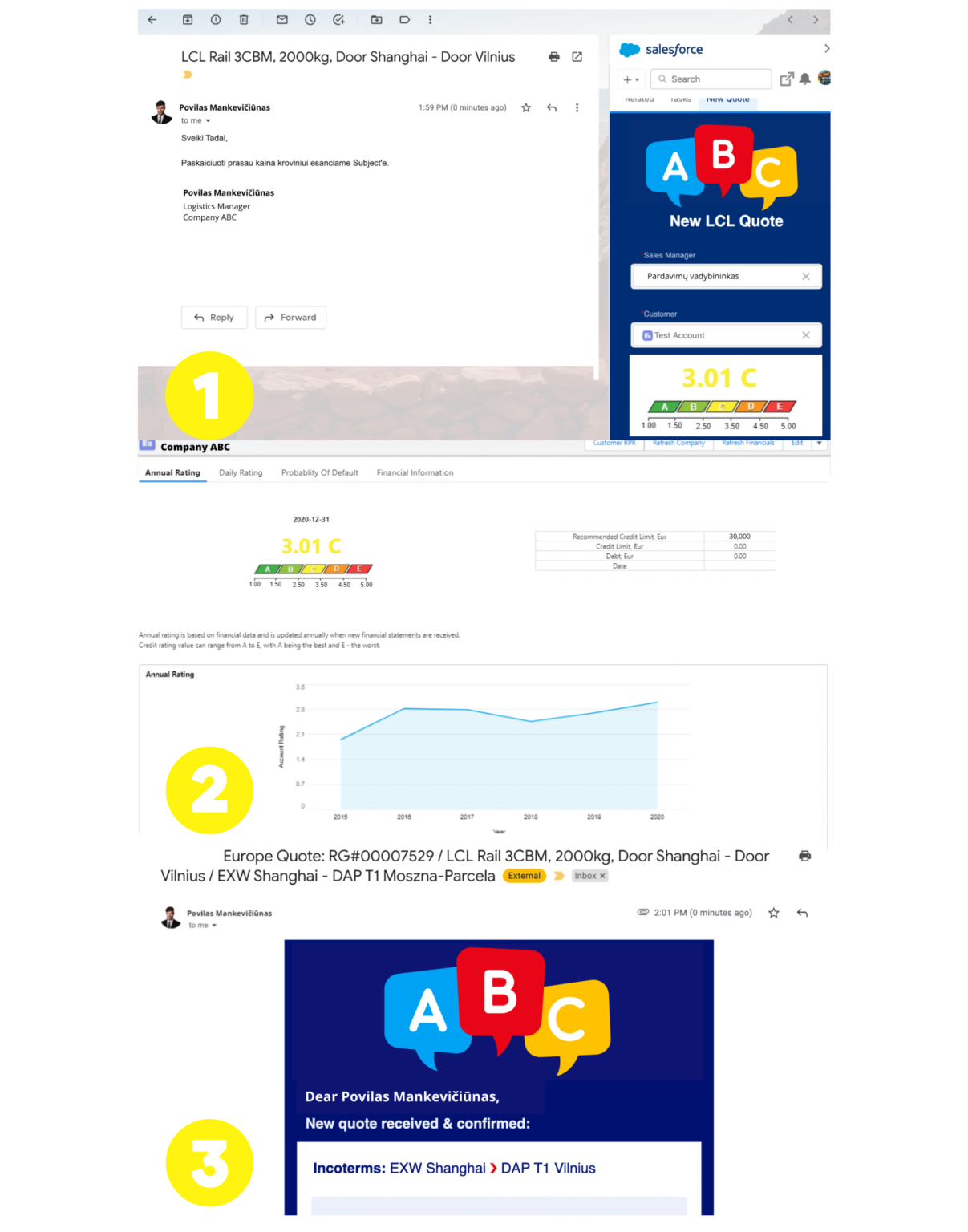

1) Jūsų pardavimų vadybininkas nori sužinoti, kuriems jūsų esamiems klientams jis gali parduoti dar daugiau.

2) RiskPlanner platformoje vadybininkas gali matyti bei segmentuoti esamus klientus. Pavyzdyje matomas darbalaukis, kuriame matosi tekstilės industrijos esami klientai. Pardavimų vadybininkas gali matyti, kiek kiekvienas klientas yra įsiskolinęs jūsų įmonei.

3) Pardavimų vadybinko darbas palengvėja, kadangi jis mato visas galimas rizikas ir gali paskatinti pirkti daugiau.

Nauda: Galite stebėti klientus, kurie dar nėra išnaudoję savo kredito limito ir paskatinti pirkti daugiau. Rezultatas – padidėję pardavimai bei pajamos.